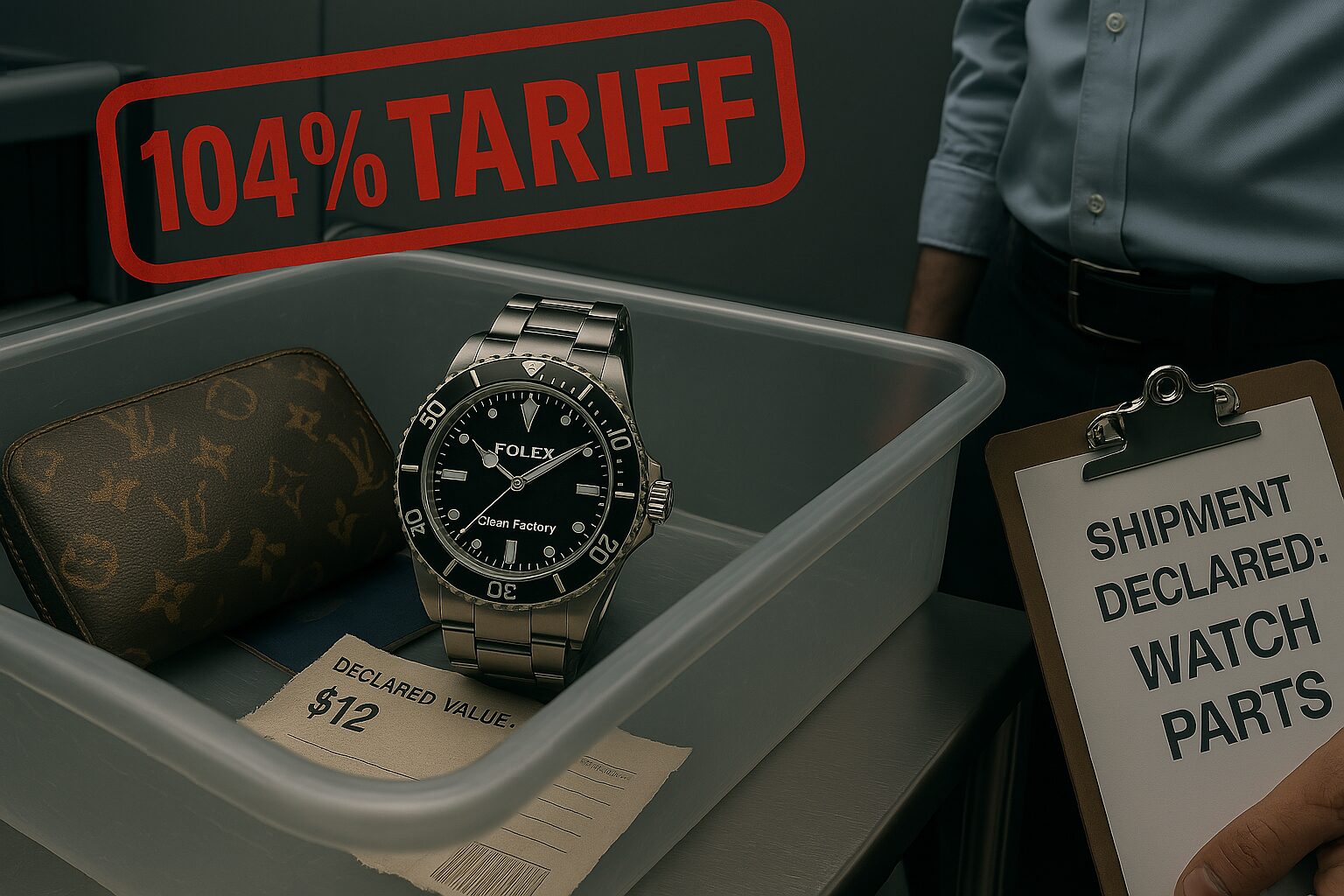

How 104% Tariffs, Vanishing Loopholes, and Market Hype Are Turning Replica Watches Into Luxury Assets

Tariffs Just Made Your Fake Rolex a Blue-Chip Investment

It finally happened. On April 9th, the U.S. government slapped 104% tariffs on select Chinese imports… watches included. Combine that with the quiet burial of the “small package exemption” (the loophole that allowed your Clean Factory Sub to sneak into the country duty-free in a recycled box labeled “watch parts”) and you’ve got the perfect storm.

Customs has officially clocked in.

The golden age of under-the-radar replica importing is over. If you’re buying from China today, you’re not just paying for a watch; you’re underwriting an international logistics operation with geopolitical risk baked in.

From Deal to Delusion: When Fakes Hit Four Figures

Here’s what the new economics look like in real-world terms. The following is not satire. It’s math.

| Replica Model | 2023 Price | 2024+ Price (Est.) | Markup Justification |

|---|---|---|---|

| Clean Submariner | $438 | $875+ | Tariff + “QC in a warzone” |

| VSF Seamaster | $520 | $1,050 | “Shipping costs + new factory tax” |

| ZF GMT Master II | $480 | $940 | “Customs risk + hand-wrapped love” |

| PPF Nautilus | $620 | $1,200 | “Price of prestige has gone up, bro” |

Some sellers are straight up doubling prices, citing tariffs, “risk premiums,” or, my personal favorite, “US Customs Uncertainty Adjustment.” Is it real? Is it just vibes? At this point, does it matter?

Scarcity, Psychology, and the Luxury Illusion

Here’s where it gets Freakonomics-level interesting. The replica market isn’t collapsing under pressure… it’s maturing! Higher prices are making fakes feel more… luxurious. A $400 Clean Sub used to be a steal. At $875? It’s suddenly a status symbol within a status symbol.

This is behavioral economics 101:

- Higher price = Higher perceived value

- Perceived exclusivity = More demand, not less

- Tariffs = Marketing tool, not deterrent

In effect, U.S. trade policy just gave replica dealers the most potent value prop in years: “It’s expensive now, because it’s serious.”

Meet the New Market: Giga-Reps and Inflationary Flexing

We’re not just buying watches anymore, we’re buying narratives. The guy on r/RepTime dropping $1,200 on a PPF Nautilus isn’t just flexing; he’s investing. That same guy is saying things like “This is basically the gen for 10% of the price, and I don’t have to wait 5 years.” He’s convincing himself he made a smart choice in an inefficient market. And honestly? He kind of did.

Supply is being throttled. Demand is still hungry. And a new class of buyer is emerging: the flex-flationist… someone who knows it’s a fake, but pays real money because everyone else is, too.

Replica sellers know this. Tariffs give them cover to push margins to new highs. Suddenly, every DM from your favorite WhatsApp dealer includes phrases like:

“Only 2 left before U.S. stops all shipments, buy now friend”

“New tariff pricing, sorry boss”

“Last batch before new stock (new price), low price for you”

A Luxury Bubble in Knockoff Clothing?

Is it sustainable? Probably not forever. But for now, replica watches are behaving like luxury commodities—volatile, emotionally charged, and disconnected from their actual cost of production. And when customs clamps harder, or enforcement tightens, or dealers get squeezed? That $1,000 fake Rolex might become even more valuable, not because of quality, but because of narrative scarcity.

Which means we’ve entered a new era in the replica game. The age of the Giga-Rep. Where buying a fake isn’t a compromise, it’s a calculated consumer rebellion, one that just got a 104% boost from U.S. policy.

So if you’re eyeing that new ZF GMT with the gen-like bezel action and correct DW alignment, just remember: it’s not just a watch. It’s macroeconomics, market psychology, and a middle finger to retail markup… all rolled into one.

And yes, it now costs four figures.